Land

Has Density Lost Lustre In The Aftermath Of The Pandemic?

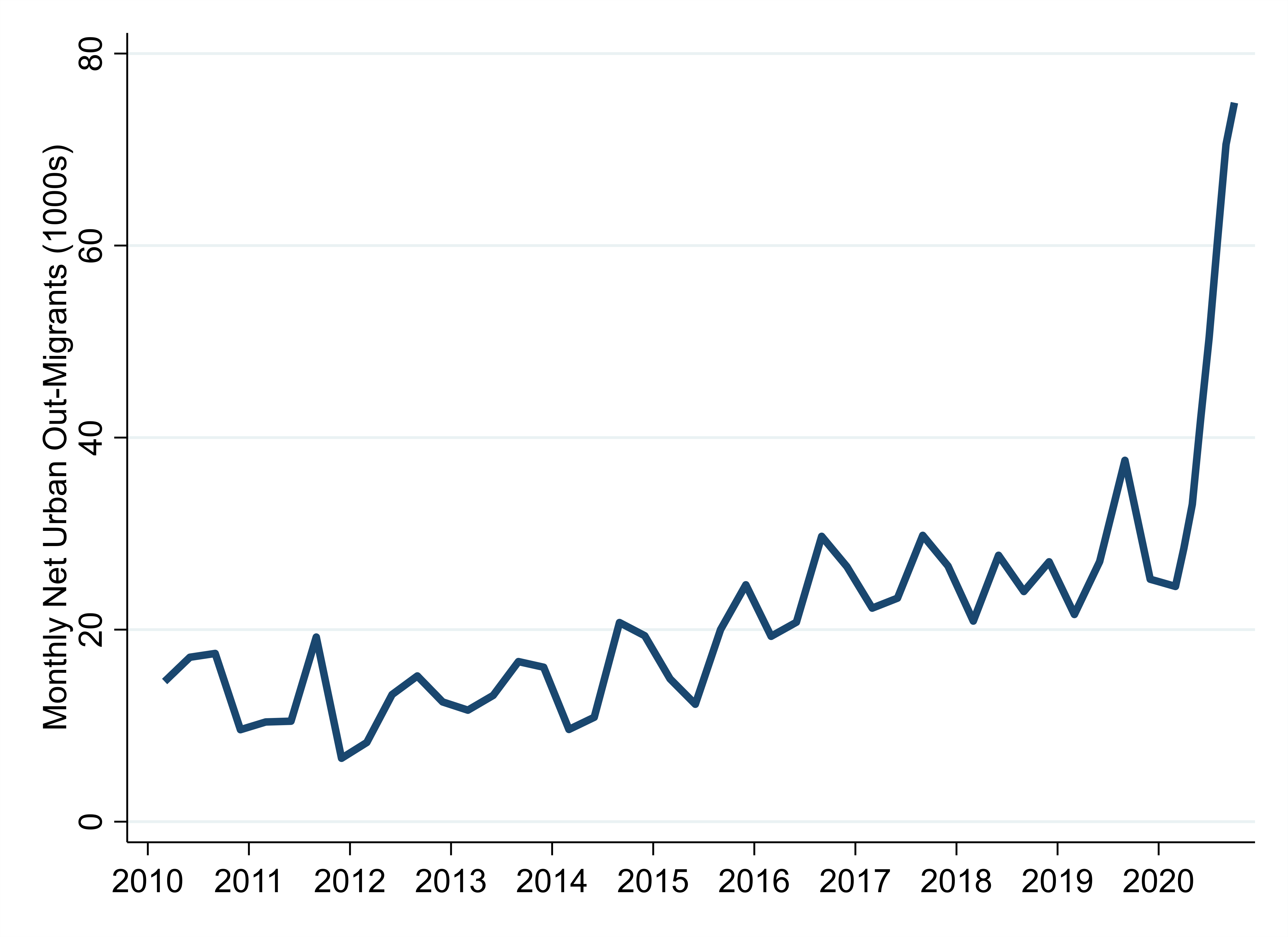

The "ins" and "outs" of net migration; what they mean to future land deals; and why they matter now.

The full-year cycle of COVID-19's whiplash suddenly exposed three distinct thesis camps around one of housing's longer-term core challenges: Density.

Imagine a room full of urban planners, metro-area elected officials, developers, real estate investors, and their partners any time up to about December of 2019. Until that moment, greater residential density went hand-in-glove with solutions to the gnarliest of housing's challenges. Whether the issue was affordability, sustainability, resilience, profit, equity dispersion, social mobility or any other chronic, housing-related "opportunity-area," the opportunity itself was better, more intentional, more creative density.

The pandemic health crisis dealt a crushing, existential blow to tightly circular consensus that led all of housing's urgencies to more vertical, smaller, higher-functioning community units as the logical solution, whatever the problem.

Now, consistent with the prevailing societal default of my-way-or-the-highway polarization, planners, investors, and the rest of the system of stakeholders find themselves caught between "the rock" of beliefs and assumptions they've long read into housing's macro direction toward density, and "the hard place" of those hypotheses in the crucible of pandemic aftershocks.

As we've noted above, three scenarios each with a base of support among experts, analysts, deal-makers, and operators have gained traction.

If the question is, has the pandemic permanently and structurally disrupted the widely-held assumption that greater density is the future – and inevitably the endgame – then those placing their bets are either believers, deniers, or it's-too-early-to-sayers.

Overstating the risk of being incorrect on the bets one places around this question would be difficult. This is because few doubt the unsustainability of demand for home lots in any number of geographic submarkets. This means that missteps on when the musical chairs music stops, and where investments are concentrated will filter big losers and a tiny few big winners.

Guidance from land strategists in times when at least some players see froth is to resist the urge to model forward-looking absorption rates at today's pace, and instead look at normative, tried-and-true sales and delivery models as reality.

- Has downtown density become a coronavirus casualty in the pandemic's wake? Bets, pro or con, may go down as one of an instant-gratification society's confusing and costly head-fakes.

- Mistaking a fad for a trend – especially as developers and builders are penciling and committing capital for deals for 36 to 60 months hence – can drive up path-of-growth lot prices and lead to greater risk of downturn exposure.